A round-up of the latest property market news, collating survey data, statistics, trends and information about the property market.

UK House Price Index

Data source: Land Registry

UK average house price = £226,351, up 0.1% in the month, up 3.0% in the year. Monthly index (where January 2015 = 100) is 118.7

May’s 3.0% growth rate is the lowest since July 2013, when it was also 3.0%. The East Midlands saw annual growth of 6.3%, while London fell by -0.4% (the fourth consecutive month of fall for London).

New instructions were positive for the first time in 27 months but sales expectations were flat. The number of residential housing transactions fell by -0.5% compared to the same period in 2017. The demand for new build property is stronger than existing property, but are becoming more difficult to sell than a year ago.

In the year to May 2018, detached property increased in value by an average 4.7%, while the price of flats and maisonettes fell by -0.9%. This reflects the fall in London prices, which accounts for 30% of England’s flats and maisonettes.

Halifax

UK average house price = £225,654, up 0.3% in the month, down -0.7% in the quarter, up 1.8% in the year.

The number of mortgage approvals has slowed down in 2018, despite the UK employment market gaining strength, which will ease household financial pressures.

A shortage of properties coming onto the housing market will continue to support house prices. A slight increase in homes for sale was seen in May after falling for 26 successive months, although new buyer enquiries declined.

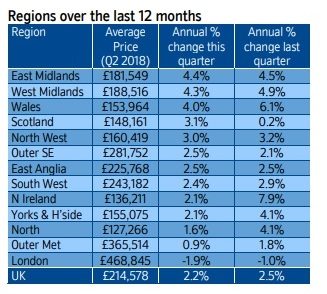

London was found to be the weakest performing region, with prices down 1.9% year-on-year to £468,845.

London was found to be the weakest performing region, with prices down 1.9% year-on-year to £468,845.